Latest

See what's going on at Citizen Machinery

15 01 26

Ten Sliding-head Lathes In Five Years Transform Production Efficiency

Established in 1995, toolmaking, metal pressings and plastic injection moulding services provider TWP Manufacturing Group, Tipton, started making a range of proprietary products after the financial crisis of 2008 to…

07 01 26

Two More Citizen Lathes Bring The Total At Luton Subcontractor To 21

The decision to set up a turned parts subcontracting business at the start of the worst economic crisis in living memory has paid dividends for Yian Stavrou and George Dingley,…

07 10 25

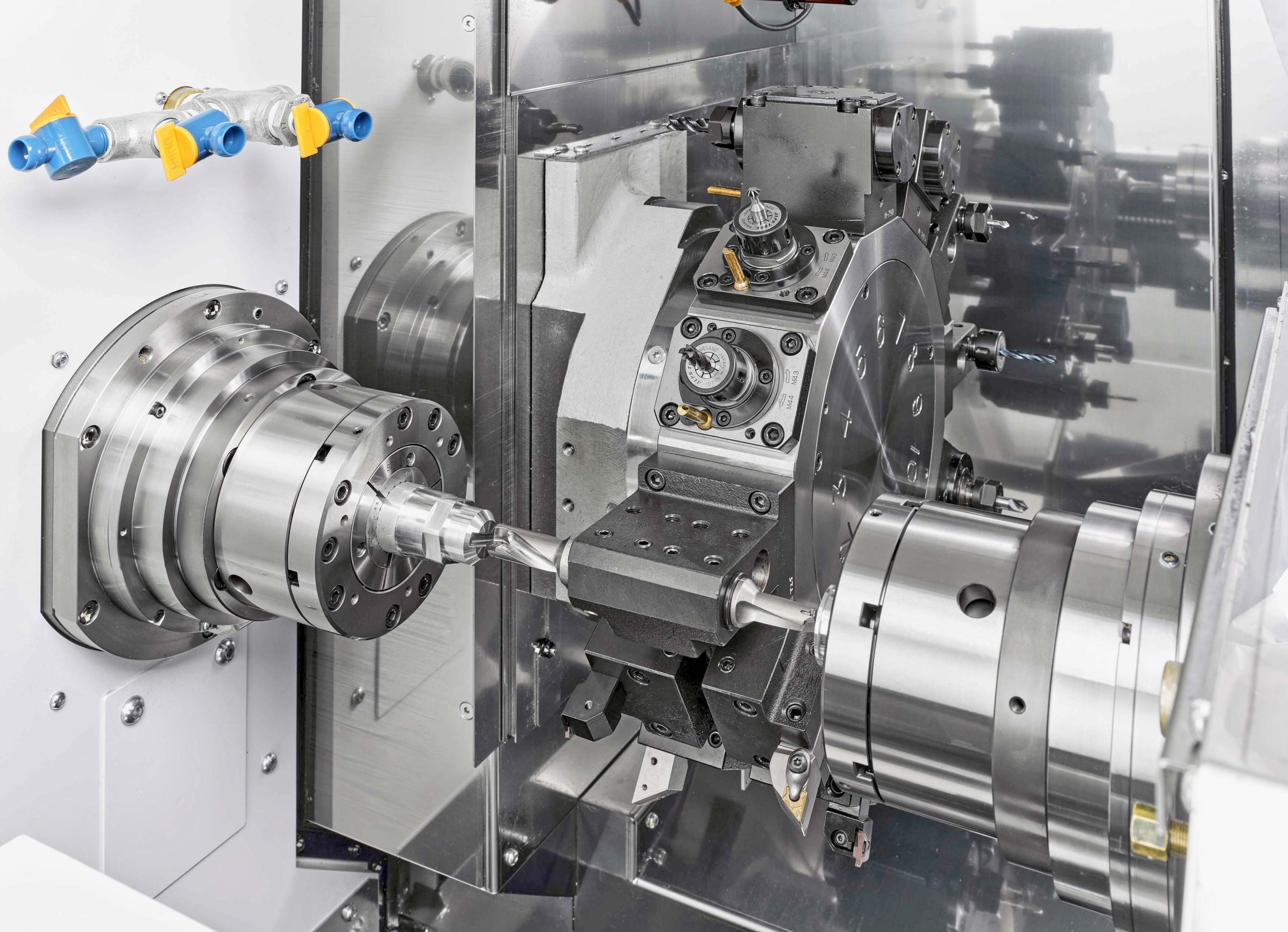

Citizen Expands Its Single-turret Lathe Offerings To Process Larger Bar Diameters

The twin-spindle, single-turret, fixed-head lathe programme offered by Citizen Machinery UK has been expanded with the introduction of a second generation of the Miyano BNX range. The first iteration, launched…